28+ Tax and insurance calculator

If you have more than 10828 in church employee income you will need to pay self-employment taxes on that income. Self-Employment Tax Calculator.

28 Quotation Samples Pdf Word Free Premium Templates

The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023.

. Such as federal income tax allowances or health insurance deductions all of which vary from person to person. Related Income Tax Calculator Budget Calculator. Intangible tax on promissory note Buyer Expense Documentary stamp tax on Mortgages Buyer Expense are taxed based on the full amount of the indebtedness regardless of whether it is contingent or absolute at the rate of tax is 0.

This next calculator lets you try it out with your own numbers. Additional 450 for electronic submission fee. This marginal tax rate means that your immediate additional income will be taxed at this rate.

The money received as the maturity benefit of a unit-linked insurance plan is tax-exempted as per section 10 D of the Income Tax Act 1961. In this example you would enter 12000 into the income field on the Tax Calculator. This puts you in the 25 tax bracket since thats the highest rate applied to any of your income.

Cheap Life Insurance Life Insurance Calculator. I am an Independent Contractor Commission Earner source code 3606 3616 is on my IRP5IT3a. And self-employed health insurance expenses.

This does not include any income you received as a minister which was entered above. Louisianas state cigarette tax of 108 per pack of 20 cigarettes. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more.

An assesment value of 455 500 and fictive property tax rate of Toronto. Louisiana Cigarette Tax. For insurance plans issued on after April 1 2012 the exemption is permitted specifically for the plans where the payable premium for each year is up to 10 per cent of the assured sum.

Your average tax rate is 169 and your marginal tax rate is 301. For the Employment Insurance System EIS employee contribution rates are similarly setup with those under age 60 contributing 02 while also incorporating a maximum cap on the applicable income. For example if you have had 8000 tax withheld to 28 th of Feb you can divide this by 8 months to work out your monthly earnings and times this by 12 months to capture the full year.

Medical Insurance Life Insurance. Enter the tax relief and you will know your tax amount tax bracket tax rate. The state also offers tax credits.

This is equal to the median property tax paid as a percentage of the median home value in your county. But as a percentage of the whole 100000 your tax is about 17. Employees and employers typically pay half of the 124 Social Security 145 Medicare benefit each for a total of 153.

In addition to sales taxes alcohol in Louisiana faces additional excise taxes. On August 28 the IRS issued. A tax planner tax calculator that calculate personal income tax in Malaysia.

These add up to 040 per gallon of beer 076 per gallon of wine and 303 per gallon of distilled spirits. 2 of premium and all feescharges EXCLUDING the Surplus Lines Service Charge State of Oregon Fire Marshal Tax. The above rates are separate from Federal Insurance Contributions Act taxes which fund Social Security and Medicare.

Use our income tax calculator to find out what your take home pay will be in Oklahoma for the tax year. You can also use the mortgage tax benefit calculator provided here. This marginal tax rate means that your immediate additional income will be taxed at this rate.

This 90k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Ohio State Tax tables for 2022The 90k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Ohio is used for calculating state. Overview of Ohio Taxes. I receive a Travel Allowance or Taxable Reimbursive Allowance source code 3701 3702 is on my IRP5IT3a.

For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. For instance an increase of 100 in your salary will be taxed 3009 hence your net pay will only increase by 6991. Use our income tax calculator to find out what your take home pay will be in New Jersey for the tax year.

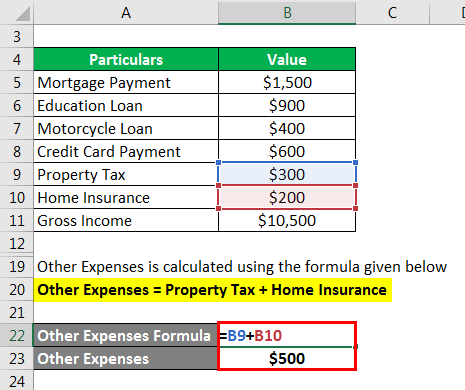

Property tax Municipal tax Education tax Other taxes Calculation example Take for example. 03 of premium and all feescharges EXCLUDING the Surplus Lines Service Charge Surplus Lines Service Charge SLSC. Municipal tax of 0451568 education tax of 0161000 and other taxes of 0002202 for a total in property tax of 0614770.

But theres another way your location can impact your tax rate. Which situation fits you. Ohio Property Tax Calculator.

This income tax calculator can help estimate your average income tax rate and your take home pay. If you get the full credit your net FUTA tax rate would be just 06 42 plus whatever you owe to your state government. State of Oregon Premium Tax.

Your average tax rate is 217 and your marginal tax rate is 360. On the First 2000000 Next ringgit. US Tax Calculator and alter the settings to match your tax return in 2022.

Categories Of Tax Relief In Malaysia. Each state runs its own unemployment insurance program and your location can impact both your SUI rate and potential tax credits. In our calculator we take your home value and multiply that by your countys effective property tax rate.

However in the context of personal finance the more practical figure is after-tax income sometimes referred to as disposable income or net income because it is the figure.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

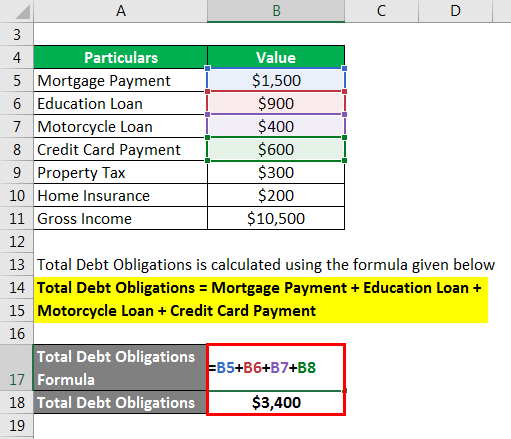

Total Debt Service Ratio Explanation And Examples With Excel Template

Payslip Templates 28 Free Printable Excel Word Formats Business Template Templates Excel Templates

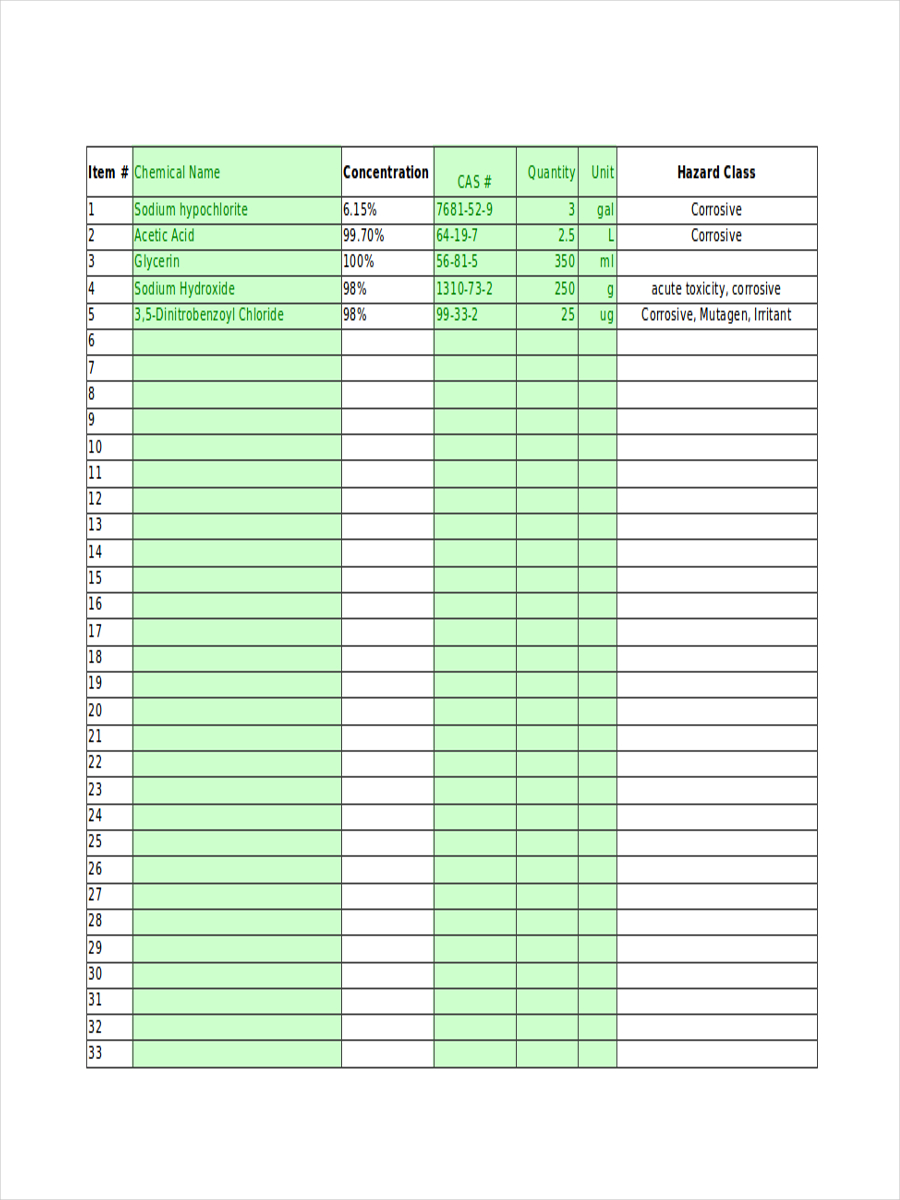

Inventory In Excel 28 Examples Format Sample Examples

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

The Cason Group Thecasongroup Twitter

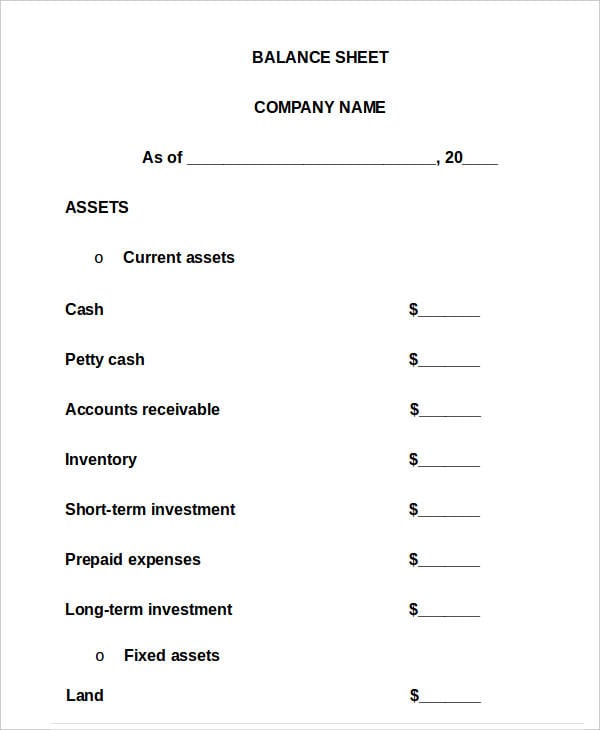

28 Sheet Templates In Word Free Premium Templates

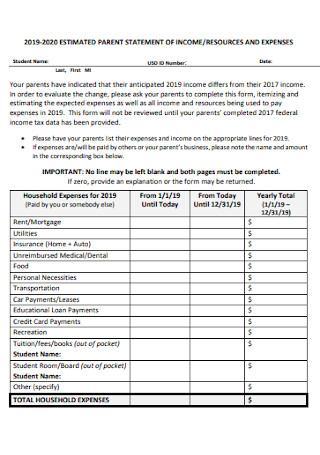

28 Sample Income And Expense Statements In Pdf Ms Word

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Business Template

Total Debt Service Ratio Explanation And Examples With Excel Template

0 Old Highway 50a Tract 3 Columbia Tn Mls 2429623

Payslip Templates 28 Free Printable Excel Word Formats Excel Templates Excel Templates

Retirement Checklist Templates 7 Free Docs Xlsx Pdf Checklist Template Excel Templates Business Worksheet

Payslip Templates 28 Free Printable Excel Word For Writing Practice Worksheets Kindergarten Subtraction Worksheets Kindergarten Worksheets Free Printables

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Wisconsin Appraisal Continuing Education License Renewal Mckissock Learning