Accumulated depreciation formula straight line

To calculate the straight-line depreciation rate for your asset simply subtract the salvage value from the asset cost to get total depreciation then divide that by useful life to get. This account is paired with the fixed.

Depreciation Methods Principlesofaccounting Com

To calculate depreciation using a straight line basis simply divide net price by the number of useful years of life the asset has.

. The formula for the straight-line depreciation method is quite straightforward to calculate. It splits the yearly depreciation expense evenly over the. The straight-line method is a simple method for calculating accumulated depreciation.

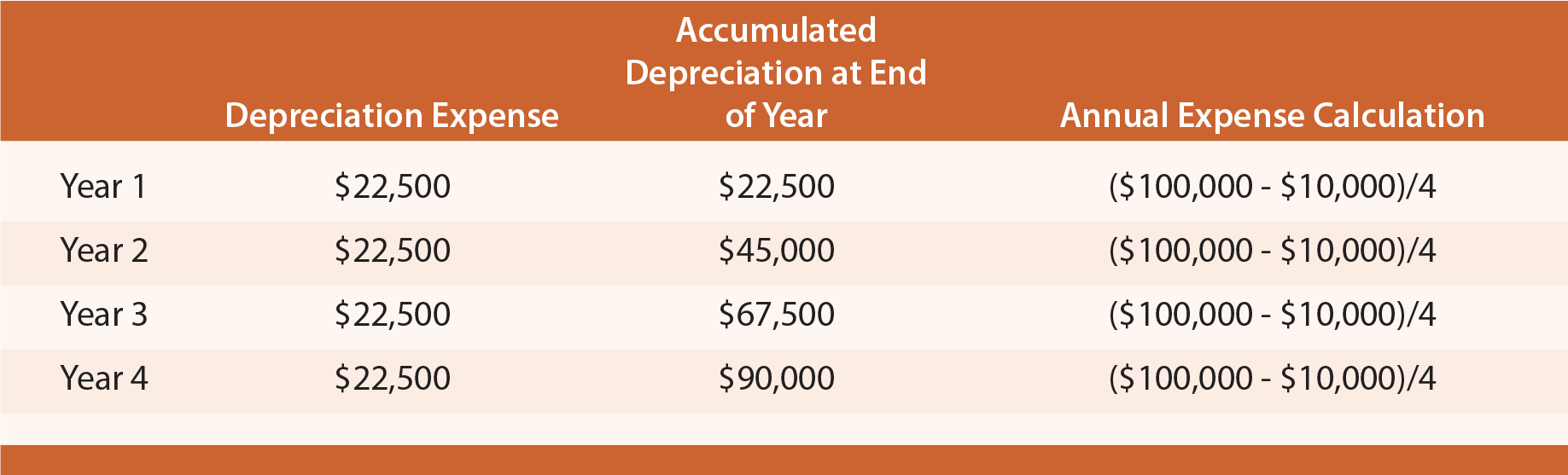

Annual depreciation 7000 - 2000 10 5000 10 500 According to straight line depreciation the company machinery will depreciate 500 every year. Accumulated depreciation has a credit balance because it aggregates the amount of depreciation expense charged against a fixed asset. The straight-line method of depreciation posts the same dollar amount of depreciation each year.

The units of production method is based on an. Let us take the same example of how to calculate. Annual Accumulated Depreciation Depreciable Base Inverse Year Number Sum of Year Digits Company ABC purchased a piece of equipment that has a useful life of 5.

The straight line depreciation method requires only that you determine the useful life of the asset estimate salvage value and calculate annual or even monthly depreciation. Depreciation Expense Cost of Asset Scrap value Useful life time. Understanding asset depreciation is an important part of.

When the assets scrap value is subtracted from its cost the remaining amount becomes the depreciable cost. Now the depreciation formula for the straight-line method will be. For year 1 the.

Straight Line Depreciation Formula Depreciation expense will be calculated by the total cost of fixed assets less scrape value and divided by useful life. The straight-line method of depreciation posts the same dollar amount of depreciation each year. Straight Line depreciation expense.

The straight-line method of depreciation is the most basic way. 500000 100000 10. This formula looks like this.

The straight-line method is the primary method for calculating accumulated depreciation and may be the most straightforward way of determining an assets loss of value. 2 x Straight-line depreciation rate x Remaining. Cost of Assets.

The formula first subtracts the cost of the asset from its salvage value. Where Book value of. Accumulated Depreciation Formula will sometimes glitch and take you a long time to try different solutions.

The final method for calculating accumulated depreciation is the SYD or sum of the years digits. LoginAsk is here to help you access Accumulated Depreciation Formula. Straight-line depreciation is a simple method for calculating how much a particular fixed asset depreciates over time.

The formula first subtracts the cost of the asset from its salvage. The accumulated depreciation formula using the straight-line method requires the total expected lifespan of an asset. Depreciation Expense Remaining Useful Life Sum of The Years.

LoginAsk is here to help you access Accumulated Depreciation Formula quickly and. For the double-declining balance method the following formula is used to calculate each years depreciation amount. Accumulated Depreciation Formula Accounting will sometimes glitch and take you a long time to try different solutions.

Book value residual value X depreciation rate. The Straight-line Method.

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

Straight Line Depreciation Accountingcoach

How To Calculate Straight Line Depreciation Depreciation Guru

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Accountingcoach

Depreciation What Is The Depreciation Expense

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Calculation Explained With Example

Accumulated Depreciation Formula Calculator With Excel Template

1 Free Straight Line Depreciation Calculator Embroker

What Is Depreciation Meaning And Calculation Striaght Line Method In Ur Method Meant To Be Line

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Double Entry Bookkeeping

Accumulated Depreciation Definition Formula Calculation